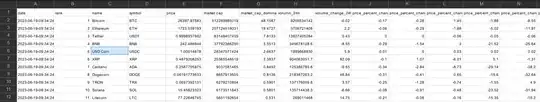

I am scraping data from crypto site and want to use neural network algorithm for predicting data. the way i save data is like these:

and there is bunch of other features like open/high/low/close for each coin. the data scrap a crypto site in a specific intervals and store them like the picture above.

I want to train LSTP model on them when I gather enough data and my question is should I store data for each coin seperately or just put the data in a file like the way I store them in the picture above is fine?

regarding these, a broader question is that can we train a single network for whole crypto market? or in the way we save data for each coin seperately, we should train a network for each one seperately too.